30+ Retirement analysis calculator

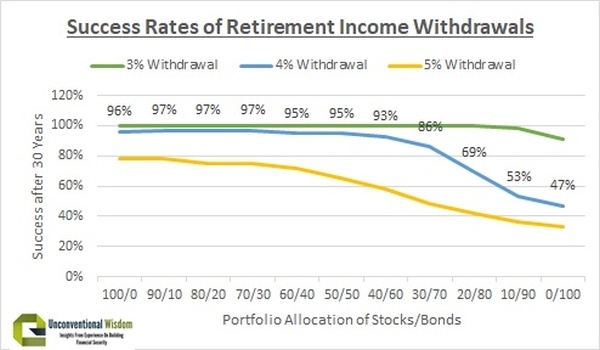

For example an analysis by Forbes reckoned that in 90 of historical markets a. High scoring 3 out of 3.

30 Money Saving Challenges To Start Today 52 Week Money Saving Challenge Money Saving Strategies Money Plan

Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72t early distribution analysis.

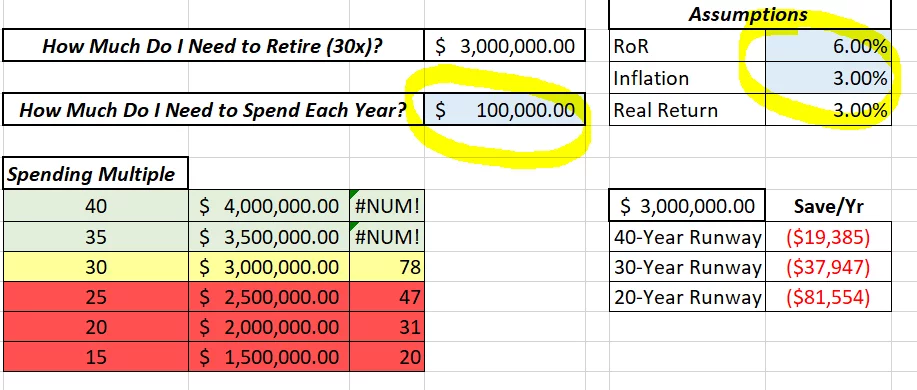

. The break even calculator exactly as you see it above is 100 free for you to use. As an example assume that S60000 per year and that it is desired to replace R repl 080 or 80 of pre-retirement living standard for p30 years. In applying this information to your individual situation you should.

And if youre 50 or older you can. Chance of producing 45000 a year in income for 30 years with a 60. Increase your sales with this simple yet powerful presentation and analysis tool.

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. This pre-retirement calculator was developed to help you determine how well you have prepared and what you can do to improve your retirement outlook. You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type desired.

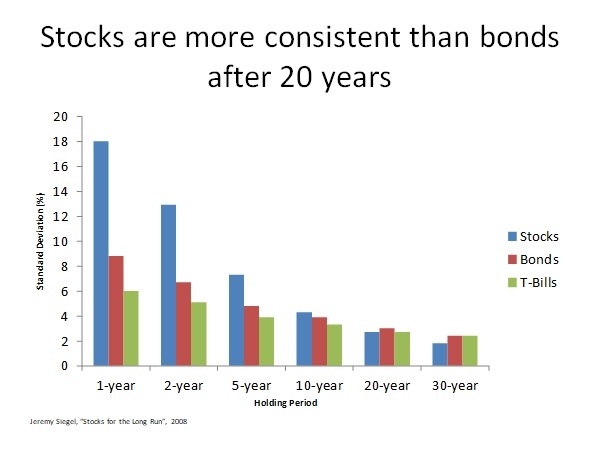

Starting at 62 your payment would be 30 percent less or 1050 per month. Living expenses and spending habits typically drop over the course of a 30 year retirement equating to a 5-15 reduction in annual spending. MC30 is a curated basket of 30 investment-worthy.

Easily perform what-if scenarios and produce charts and tables showing retirement needs and asset growth projections. IFA Index Portfolios 25. The AARP Retirement Calculator can help you develop a picture of your financial future taking into account all sources of retirement income and estimating.

Results to yourself for later analysis. The estimates and insights from the calculator can help you prepare for retirement and help frame your conversation with a financial advisor. In the case of early retirement a benefit is reduced 59 of one percent for each month before normal retirement age up to 36 months.

IFA Index Portfolios 15. Calculate what your savings will be in 10 20 or 30 years. Use our personal retirement calculator to find out how much you may need to retire and if youre on track for retirement.

Good scoring 26 out of 3 Scorecard Components. 30-year 20-year 15- year and interest-only fixed rate mortgage pools are included in the Index. You can put in up to 6000 a year.

Assume for current purposes. However if you retire at the Minimum Retirement Age MRA with 10 service but less than 30 years of service your benefit will be reduced by the age reduction. Research shows that individuals consumption gradually drops over the course of a 30 year retirement even though health care costs typically increase as a percent of overall consumption.

They will not factor into any of the analysis or results. IFA Index Portfolios 20. A ge Reduction - Your MRA annuity will be reduced by 5 percent per year 512 of 1 percent for each month in which your retirement date precedes your 62nd birthday.

The ability to add Social Security. Retirement plan income. Be informed and get ahead with.

The 30-year fixed mortgages in this weeks survey had an average total of 043 discount and origination points. The number of years until start of retirement using the desired retirement age minus current age entered in the Retirement Expense Income Calculator. Monthly Retirement Expenses Income Gap Analysis Proposed Gap Solution.

IFA Index Portfolios 10. If the number of months exceeds 36 then the benefit is further reduced 512 of one percent per month. The Ultimate Retirement Calculator.

If you have less than 20 years of service credit you will receive 2 percent of your Final Compensation for each year of service. Retirement Savings Calculator Am I saving enough for my retirement. Track your portfolio 24X7.

Then enter the loan term which defaults to 30 years. Use the personal retirement calculator explore your finances in depth. Retirement can be the happiest day of your life.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999. Home Budget Analysis Net Income. A If you have at least 20 years but less than 25 years of service credit you will receive 50 percent of your Final Compensation.

Use this calculator to see how many years it would take you to break even buying a new furnace. Vanguard Retirement Nest Egg Calculator. Bottom-up analysis assesses individual stocks by using their merits.

The 72t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. Invest In MC 30. Types of Investment Analysis.

Living Benefit Charge 135. The assumptions keyed into a retirement calculator are critical. Available at age 55 with no minimum amount of service required.

To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. The calculator below gives you the amount with all credits applied for comparison purposes. However investment analysis can be divided into a few different categories.

It is important that you re-evaluate your preparedness on an ongoing basis. An individual retirement account is one of the most popular ways to save for retirement given its large tax advantages. Invest in Direct Mutual Funds New Fund Offer NFO Discover 5000 schemes.

The AARP Retirement Income Calculator estimates how much youre projected to have by a target retirement date and estimates the minimum amount youll likely needIt shows results in terms of yearly cash flow streams. Make your retirement plan solid with tips advice and tools on individual retirement accounts 401k plans and more. With all the data and financial information available there are a variety of methods analysts and investors use.

Over the past 52 weeks the 30-year fixed has averaged 432 percent. Rate and hybrid residential mortgage pass-through securities publicly issued by US agencies in the US domestic market. So between the ages of 62 and 67 you would receive approximately 63000 in benefits 1050 for 60 months.

Break-even analysis is a common tool that is used to figure out the economic feasibility of production of an item no matter what the item may be.

How To Invest Money 13 Proven Investment Tips You Must Know Investment Tips Investing Investing Money

Can We Retire Now Retirement Rules Of Thumb Retire Happy

Same Chart Different Traders Video Trading Charts Forex Trading Quotes Stock Trading

7 Best Side Hustles To Make 1000 In A Weekend ǀ Empower Multimedia Side Hustle Money Basics Make More Money

How Much Do I Need To Retire As A Physician Wealthkeel

How To Stop Living Paycheck To Paycheck Budgeting Money Saving Tips Financial Tips

Daniel Ally How Rich People Spend Their Money Finances Money Budgeting Money Education Funding

8 Easy Money Management Steps To Improve Your Finances Tonight Budgeting Finances Money Management Budgeting

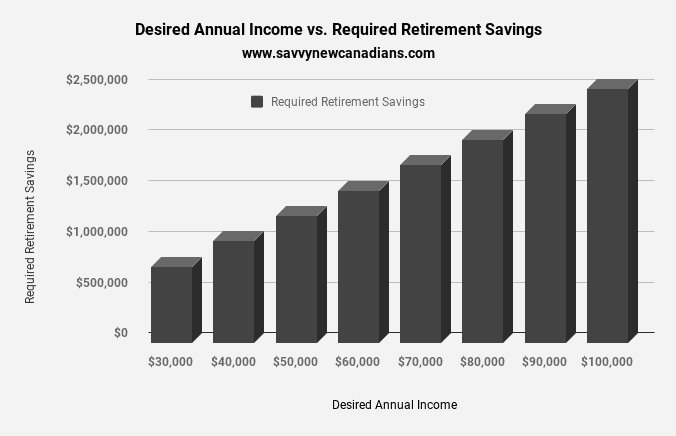

How Much Money Do I Need To Retire In Canada In 2022

Can We Retire Now Retirement Rules Of Thumb Retire Happy

Can We Retire Now Retirement Rules Of Thumb Retire Happy

The Most Important Investment Spreadsheet For Dividend Investors Dividendstrategy Ca

The Best Retirement Calculators 2022 Can You Retire Early Part Time Money

The Best Retirement Calculators 2022 Can You Retire Early Part Time Money

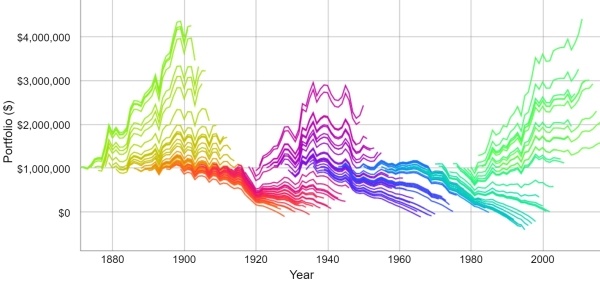

Using Leverage In Retirement Swr Series Part 49 Early Retirement Now

Event Budget Template Event Budget Template Event Budget Budget Spreadsheet

With Age Comes Great Responsibilities And At The Top Of Your List Should Be Taking Charge Of Your Money Www Levo Com Finance Personal Finance Budgeting Money